Money may not grow on trees in this world but there are hidden funds out there waiting for you to claim what is rightly yours. This may sound too good to be true but each year there are unclaimed assets that are turned over to federal and state governments after unsuccessfully trying to locate the rightful owner.

With over $49 Billion in unclaimed assets, forgotten and abandoned property has turned into a huge source of potential revenue for the federal and state governments in the United States. For detailed information you can download our FREE e-Book right here!

How do I Locate My Unclaimed Assets?

For detailed information you can download our FREE e-Book right here!

There is not a one-stop shop to search for assets, but this e-Book makes the search easier so you can understand where to start. One thing to keep in mind is that each state has a different time frame for allowing rightful owners to file a claim on unclaimed property. Many states, including California and Florida, will hold unclaimed property indefinitely, giving owners all the time needed to locate and claim their hidden funds. However, other states limit the timeframe for when rightful owners can come forward to claim their abandoned property. Some states have even recently revised their laws, shortening the timeframe that rightful owners can make claims on hidden funds, allowing more property to be turned over to state ownership. [1]

The limits on when you can file a claim for your assets highlights the importance of taking steps now to learn about unclaimed property, search the databases, locate your hidden funds and make a claim to have them returned to you. If you wait, it becomes more likely the state could retain your hidden funds.

What Hidden Funds are held with the Federal Government?

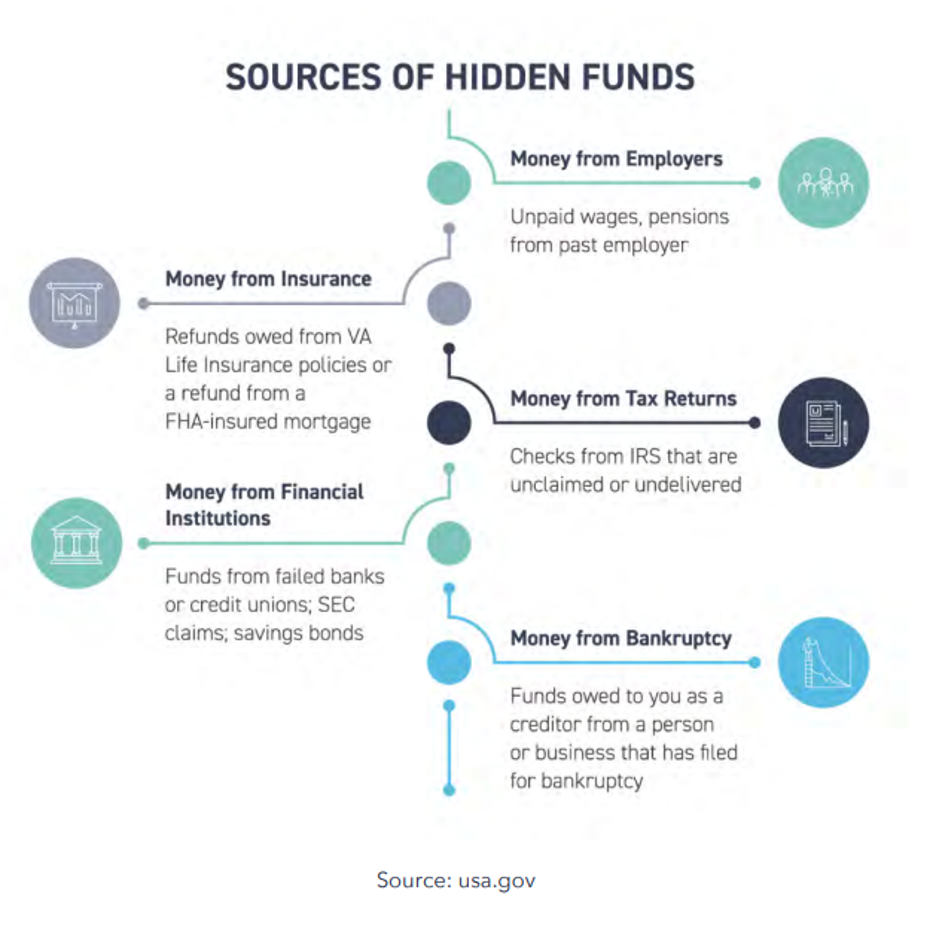

The federal government is in charge of various agencies that promote and protect various interests of American citizens. The following assets are held by federal government agencies that are responsible for keeping unclaimed assets safe for rightful owners.

Back wages held by The Department of Labor. The Department of Labor, aka the “DOL”, focuses on the welfare of wage earners, job seekers, and retirees. This agency focuses on working conditions, profitable employment; and administering work-related benefits and rights. If there is a dispute between an employee and employer on the amount paid to an employee, a case can be filed with the DOL. Or the DOL may independently investigate and discover pay violations. As part of resolving pay disputes, the DOL may order the employer to pay back wages to remedy the violations. Under these circumstances, the agency collects the back wages on behalf of the employee. If the employee cannot be immediately located, the agency continues its search efforts for three years. After that time, if the employee can still not be located, the agency is required to send the back wages to the U.S. Treasury. To determine if you have back wages as hidden funds, visit the DOL Website.

Mortgage Insurance Refunds held by Housing and Urban Development (“HUD”)

HUD is the national agency responsible for fair housing laws and developing programs that address America’s housing needs. One of the more well-known programs that HUD administers is the mortgage loan insurance through the Federal Housing Administration (“FHA”). When purchasing a home, a loan officer may introduce an “FHA loan” as one option that a buyer can qualify for to buy a home. These loans often have lower down payments, lower closing costs, and lower credit scores are needed to qualify. However, these loans require the buyer to have mortgage insurance, which is a certain percentage charged on the loan each month. If the buyer later -19- refinances the loan or sells the home, they may be due a refund on their FHA mortgage insurance.To determine if you are due a mortgage insurance refund, visit HUD’s website.

Tax Returns held by the Internal Revenue Service (“IRS”)

The IRS collects taxes. After tax returns are filed, a refund may be owed to the individual or company for overpayment of taxes. While many use direct deposit for tax returns, it is still an option to have the IRS mail a check. If those checks are unclaimed or undeliverable, the agency retains them as unclaimed property.To determine if you have an outstanding tax return to claim, search the IRS’s website.

Unclaimed assets held with State Governments

The search for hidden funds does not stop with the property held with the federal government. A search for assets like gift certificates, insurance policy payouts, and safety deposit boxes, actually begins in the databases maintained by state governments. Since abandoned property is turned over to the state in which the owner lived, an unclaimed property search only needs to be limited to the states in which you have resided. Simply visit the state’s website, locate its division of unclaimed property to start a search and process your claim.

Even if you have lived in multiple states, the good news is you still do not have to search every state individually. There are resources that will search across states and territories to make your search more efficient. For example, most states sync information related to unclaimed property into national databases that are available on missingmoney.com. The National Association of Unclaimed Property Administrators (NAUPA) further encourages national cooperation by leading and facilitating collaboration among administrators from the different states and territories. The NAUPA includes a list of each state’s unclaimed property website and supports all efforts to reunite unclaimed property with the rightful owner. While the multi-state search services may be a good starting point, it would be best to check each state’s database individually. The extra effort is worth the chance to take part in the millions of unclaimed assets that are waiting for rightful owners!

For detailed information you can download our FREE e-Book right here!

Here is the list of the individual state unclaimed property divisions:

Sources:

1. Citation New State Law Returns Capital Credits to Cooperatives after Three Years.” August 4, 2020. https://www.tennesseebroadband.com/2020/08/new-state-law-returns-capital-credits-to-cooperatives-after-three-years/.